LTC Price Prediction: Path to $200 Amid Technical Consolidation and Mining Momentum

#LTC

- Technical Positioning: LTC trades slightly below its 20-day moving average with neutral Bollinger Band positioning, suggesting consolidation

- Mining Development: Enhanced cloud mining platforms could improve network security and accessibility, providing fundamental support

- Competitive Landscape: Market focus shifting toward emerging layer solutions requires LTC to maintain relevance amid growing alternatives

LTC Price Prediction

Technical Analysis: LTC Trading at Slight Discount to 20-Day Average

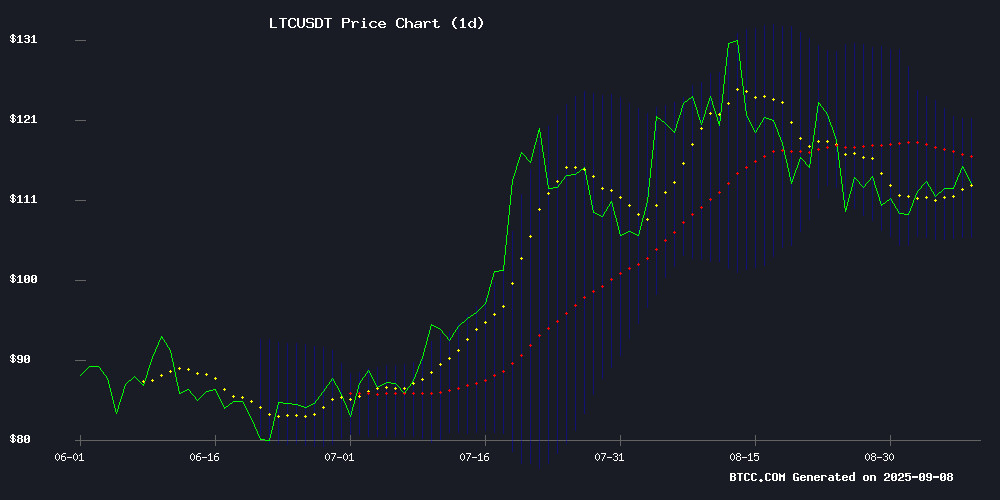

Litecoin is currently trading at $112.65, approximately 0.65% below its 20-day moving average of $113.39. The MACD indicator shows a bearish crossover with the MACD line at 4.0982 below the signal line at 4.9120, generating a negative histogram of -0.8138. Price action remains within Bollinger Bands with current levels sitting closer to the middle band, suggesting neutral momentum. According to BTCC financial analyst Olivia, 'LTC is experiencing typical consolidation after recent movements. The proximity to the middle Bollinger Band indicates balanced buying and selling pressure in the NEAR term.'

Market Sentiment: Mining Innovation Offsets Regulatory Developments

Recent news flow presents a mixed but cautiously optimistic outlook for Litecoin. The emergence of enhanced mobile cloud mining platforms like ZA Miner and AIXA Miner's scalable profit promises for 2025 provide fundamental support through increased accessibility and potential network security improvements. However, the market's shifting focus toward emerging layer solutions and alternative cryptocurrencies creates competitive headwinds. BTCC financial analyst Olivia notes, 'While mining innovations strengthen LTC's infrastructure foundation, the broader crypto ecosystem's evolution requires Litecoin to continuously demonstrate its value proposition amidst growing alternatives.'

Factors Influencing LTC's Price

ZA Miner Enhances Mobile Cloud Mining with Daily Crypto Earnings; September Market Review Highlights Volatility

ZA Miner has upgraded its mobile cloud mining platform, offering on-the-go contracts for daily earnings in Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). The move caters to retail investors seeking passive income streams amid fluctuating market conditions.

The cryptocurrency market remains turbulent, with Bitcoin briefly touching $124,500 before retreating 8% in August to stabilize near $115,000. Seasonal liquidity constraints, institutional sell-offs, and Asian regulatory concerns contributed to the pullback. Despite short-term weakness, major banks maintain bullish Q4 price targets for BTC.

Ethereum outperformed with an 11% August gain, trading between $4,700-$4,900. Surging DeFi activity and staking demand support ETH's fundamentals, with year-end projections hovering near $7,200. As the backbone of decentralized applications, Ethereum's long-term utility appears secure despite evolving competitive pressures.

Litecoin demonstrated unusual stability, holding at $72 throughout August. Its position as a low-fee transactional asset continues to attract mid-cap investors, though limited volatility reduces speculative appeal.

Spartans Casino Emerges as Crypto Gaming Leader Amid Rivalry with Betplay and Luckyland Slots

The online casino sector is witnessing a paradigm shift as Spartans, a crypto-native platform, outshines competitors like Betplay and Luckyland Slots with instant withdrawals and a library of 5,963+ games. While Betplay leverages Lightning Network for rapid crypto transactions and Luckyland attracts casual players with sweepstakes mechanics, Spartans combines innovation with Lamborghini-tier rewards—catering to demands for speed, variety, and transparency.

Betplay's minimalist design and no-minimum deposit matches appeal to efficiency-focused users, but Spartans' bold promotions and sportsbook integration set a new standard. The platform's crypto-first approach aligns with growing player preference for blockchain-based payouts over traditional systems.

AIXA Miner's Cloud Mining Platform Promises Scalable Litecoin Profits in 2025

Litecoin maintains its position as a top-tier cryptocurrency in 2025, often dubbed 'silver to Bitcoin's gold.' Its enduring appeal stems from fast transactions, low fees, and broad acceptance across exchanges and payment systems. These attributes make LTC both a stable investment and a viable mining target.

Traditional mining faces significant hurdles, including exorbitant ASIC hardware costs, massive energy consumption, and relentless maintenance demands. AIXA Miner disrupts this paradigm through cloud-based Litecoin mining, offering fixed contracts and professionally managed infrastructure. The platform claims users can generate up to $5,000 daily without hardware ownership.

Unlike ephemeral tokens reliant on market hype, Litecoin's longevity in the crypto ecosystem underscores its mining potential. AIXA Miner capitalizes on this stability by democratizing access to profitable mining operations previously reserved for industrial-scale players.

IOTA Miner Launches Mobile App to Democratize Cloud Mining for U.S. Investors

IOTA Miner, a London-based cloud mining firm, has unveiled a mobile application designed to simplify cryptocurrency mining for U.S. investors. The app offers real-time contract management, earnings tracking, and daily payouts for Bitcoin, Litecoin, and Dogecoin, among others.

The platform targets both retail and experienced traders with low entry barriers—contracts start at $15, accompanied by a $15 signup bonus and $0.60 daily login rewards. Security is bolstered by McAfee® and Cloudflare® protections, while the company claims a global user base of 9 million across 180 countries.

"Democratizing crypto mining is our core mission," stated a company representative. The app promises 1.5% daily returns, translating to $15 profit per day on a $1,000 investment. Founded in 2018, IOTA Miner emphasizes energy-efficient operations and regulatory compliance.

Crypto Market Shifts Focus from Solana and Litecoin to Emerging Layer Brett

Solana and Litecoin, once dominant players in the cryptocurrency market, are now facing diminishing returns as traders pivot toward Layer Brett, a novel Ethereum Layer 2 scalability solution combined with meme coin appeal. With $3 million already raised in its presale and tokens priced at $0.0055, Layer Brett is capturing attention for its potential to deliver 50x returns—a prospect that more established cryptocurrencies like Solana and Litecoin can no longer promise.

Solana, trading at $203.62, shows technical resilience but appears capped by its maturity. Bulls eye a breakout above $218, which could propel it toward $240–$260, but a breakdown below $198 may trigger a retreat to $175 or even $155. Meanwhile, Litecoin struggles to maintain momentum, further highlighting the market's appetite for high-growth narratives over legacy assets.

Capital Flows Into XRP and Passive Income Trends — DEAL Mining Offers Cloud Mining Solutions

XRP is back in the spotlight as on-chain data shows transfers exceeding $6 billion this week. Speculation about a potential XRP ETF is gaining traction, with CoinMarketCap reporting a 28% surge in global trading volume over the past month. Institutional and retail interest is rising, underscoring XRP's dominance in cross-border payments and the growing appetite for crypto-based passive income.

DEAL Mining, a global cloud mining platform established in 2016, has upgraded its contracts with AI-driven resource allocation and multi-currency support. The platform, serving 6.8 million users across 200 countries, enables daily passive income from cryptocurrencies like BTC, XRP, DOGE, ETH, LTC, and USDT.

The upgraded AI infrastructure optimizes hash power distribution to maximize profitability. DEAL Mining also emphasizes sustainability, expanding its use of renewable energy to reduce carbon emissions.

Solana, XRP, and Cardano May Lead First Altcoin ETF Approvals

The dominance of Bitcoin and Ethereum in the ETF market could soon face competition as the U.S. Securities and Exchange Commission (SEC) prepares for a broader wave of approvals. Analysts suggest altcoin-based exchange-traded funds are on the horizon, with assets like Solana (SOL), XRP, and Cardano (ADA) leading the charge.

Bloomberg’s James Seyffart notes that several cryptocurrencies already meet listing criteria, including Chainlink (LINK), Stellar (XLM), and Polkadot (DOT). High liquidity and established derivatives markets make these tokens strong contenders for ETF inclusion.

While Bitcoin and Ethereum remain the anchors of the ETF landscape, Ethereum’s mid-2024 rollout faced weaker-than-expected inflows. The absence of staking features left these funds appearing incomplete, though demand is expected to grow once staking integrates into ETF structures.

The first altcoin ETFs will likely focus on marquee names like Solana and XRP before expanding to diversified basket products. Approval would mark a significant milestone in cryptocurrency’s institutional adoption.

SEC Approves Bitcoin ETF Amid Rise of Cloud Mining Platforms in 2025

The SEC's approval of a Bitcoin ETF marks a watershed moment for institutional crypto adoption, coinciding with the maturation of cloud mining as a passive income vehicle. Five platforms now dominate this space, led by U.S.-based DNSBTC with its eco-friendly Bitcoin, Litecoin, and Dogecoin mining contracts offering up to 9% daily returns.

Cloud mining has evolved from hardware-intensive operations to app-based solutions, eliminating capital expenditures for retail participants. DNSBTC's tiered contracts—ranging from $60 free trials to $9,000 premium packages—demonstrate the sector's sophisticated yield structures, though regulatory scrutiny may follow these high-return offerings.

4 Best Free Cloud Mining Platforms in 2025: Passive Income Post-Bitcoin Halving

Cloud mining demand has surged in 2025 as investors seek stable passive income without hardware costs. Platforms like DNSBTC, StormGain, BeMine, and GMiner dominate the sector by offering hash power rentals for Bitcoin (BTC), Litecoin (LTC), and Dogecoin (DOGE) mining—eliminating electricity and maintenance burdens.

DNSBTC emerges as the market leader, leveraging U.S.-based renewable energy sources for eco-friendly operations. Its ASIC-powered infrastructure guarantees daily payouts, setting a new standard for transparency in cloud mining contracts.

Will LTC Price Hit 200?

Based on current technical indicators and market developments, reaching $200 would require approximately a 77.5% increase from current levels. While not impossible, this represents a significant move that would need strong catalysts.

| Target Price | Required Gain | Technical Hurdles | Key Support Levels |

|---|---|---|---|

| $200 | +77.5% | Multiple resistance zones | $105.86 (Bollinger Lower) |

| $150 | +33.2% | Psychological resistance | $113.39 (20MA) |

| $120.92 | +7.3% | Bollinger Upper Band | $112.65 (Current) |

BTCC financial analyst Olivia suggests: 'The combination of improving mining infrastructure and potential ETF developments could provide tailwinds, but investors should monitor the MACD for bullish reversal signals and watch for sustained breaks above the Bollinger upper band as confirmation of stronger upward momentum.'